Getting Started with NFT Trading: Essential Tips and Strategies for Beginners

A guide with tips & tricks to get into NFT Trading on Ethereum.

NFTs, or non-fungible tokens, have created a new industry for artists and creators to monetize their work and for collectors to own and trade unique digital assets. According to DappRadar, in 2022, the NFT market generated around $24.7 billion in trading volume across all blockchain platforms and marketplaces.

Notable companies like Nike, Adidas, Starbucks, Prada, Coca-Cola, and McDonald’s are investing in their own NFTs. I believe in 2023, even more corporations will continue implementing NFTs into their business plan.

You may think, okay, that’s great, but how does that benefit me? NFTs and the mainstream adoption of blockchain technology is an opportunity of a lifetime to be a pioneer in this space. Much like Web 2.0, the more you know, the more you’ll earn. It'll take time to grasp the market, but you should always start with the basics.

We’ll be focusing on the Ethereum blockchain in this article.

In addition, we’ll be reviewing the following:

Marketplaces and Aggregators

Data Analytic Tools

Soft Skills

Before we get started, if you aren’t familiar with digital wallets, then review this article. It’ll cover the various types of digital wallets and the pros/cons of each type.

First, let’s break down different types of marketplaces.

Marketplaces

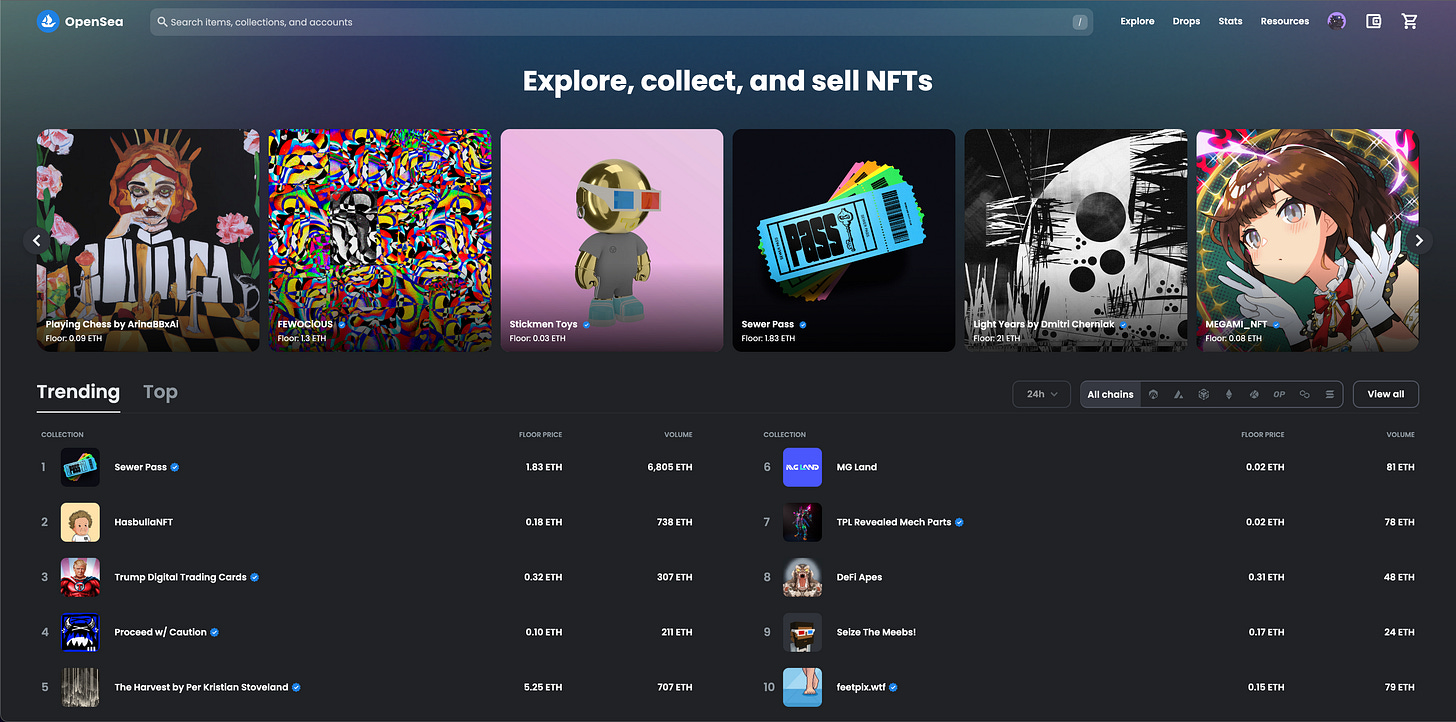

OpenSea:

Royalty Fees: 2%

OpenSea was founded in late 2017. The world’s first and largest NFT trading exchange has led the industry by curating an easy-to-use platform for users. In 2021, OpenSea accounted for more than 60% of all NFT volume (roughly $14B).

LooksRare:

Royalty Fees: 1.5%

LooksRare was founded in January 2022 to be a competitor to OpenSea. As the first rewarding NFT marketplace, it allows users to earn $LOOKS when buying/selling NFTs and staking the token.

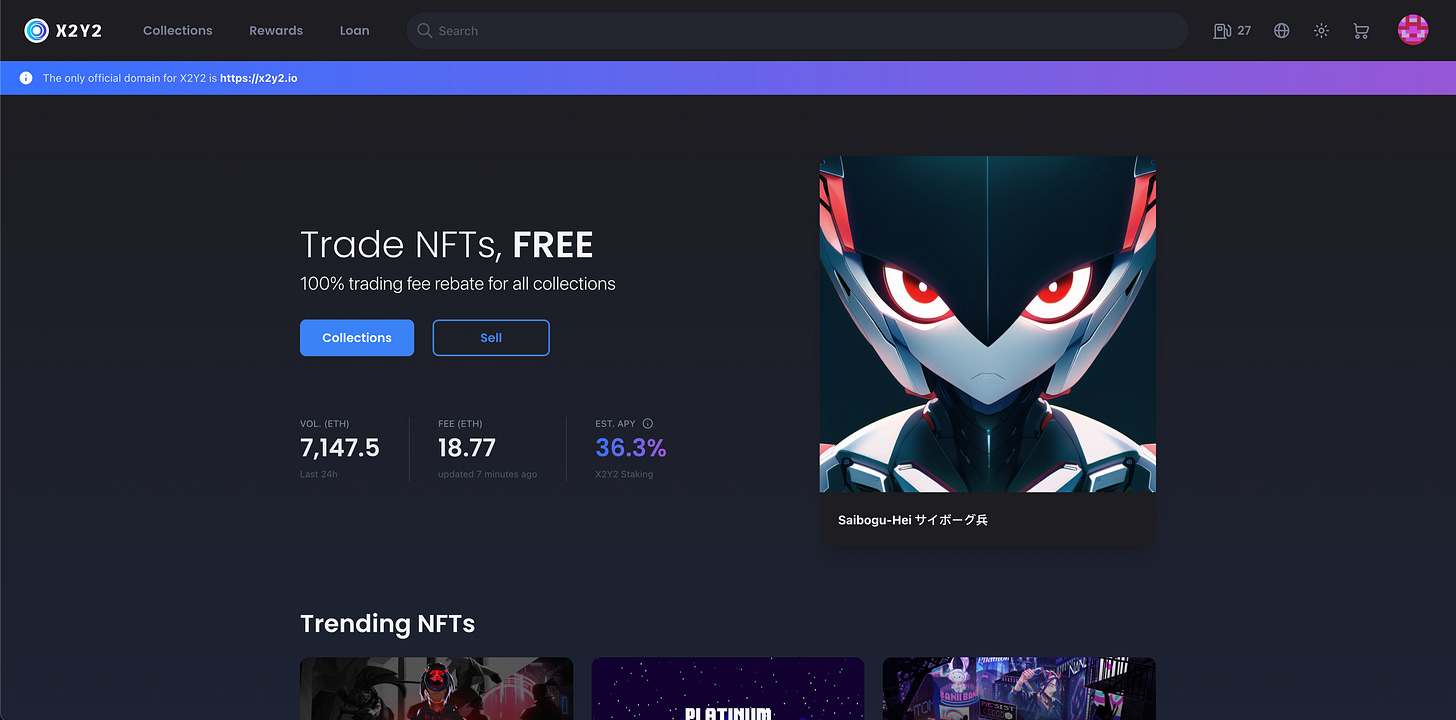

X2Y2:

Royalty Fees: .5%

X2Y2 was founded in February 2022 to compete with OpenSea and LooksRare; X2Y2 airdropped $XY2Y tokens for all users who used OpenSea. It was another NFT marketplace that rewards you for buying/selling NFTs and staking the token.

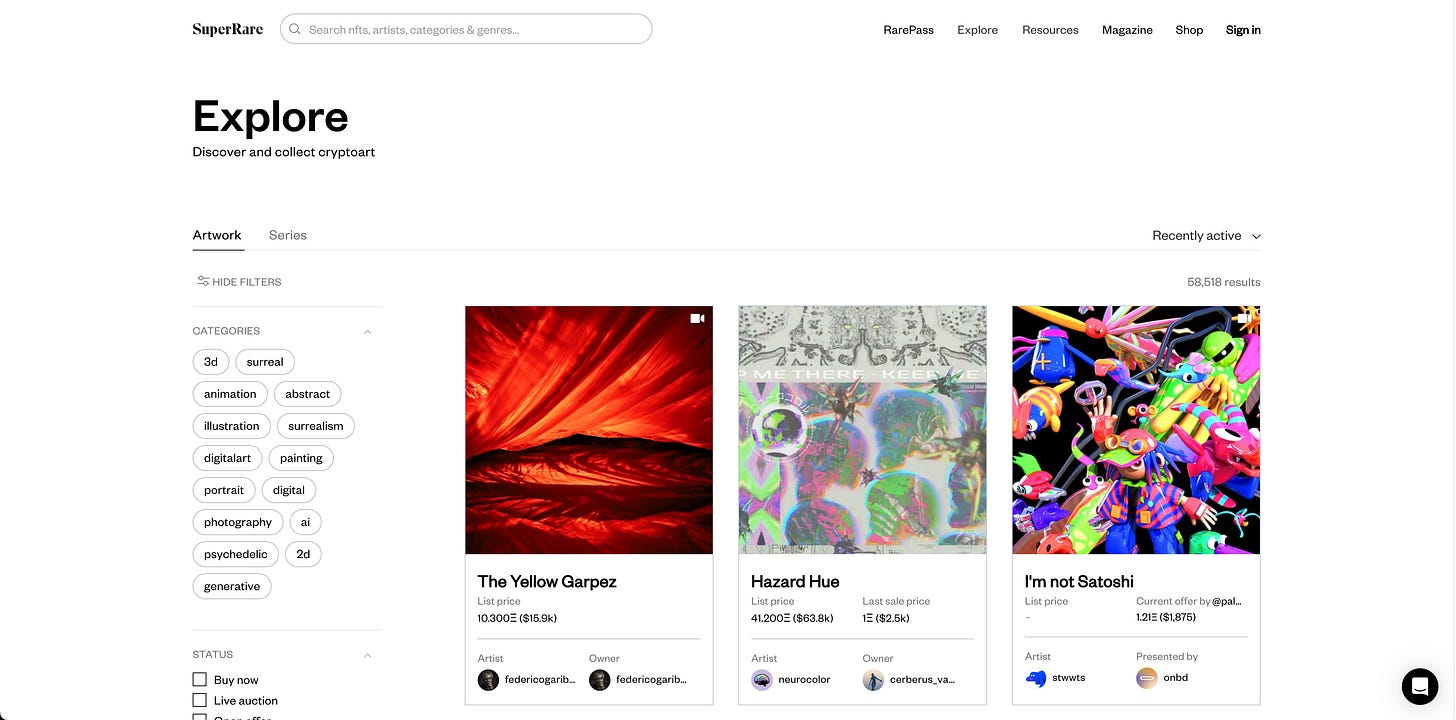

NFT Art Exchanges

SuperRare

Foundation

Nifty Gateway

These are the leading marketplaces for freelance digital artists. Some include an application process before listing art pieces. Nifty Gateway and Foundation have a 5% commission fee, while SuperRare has a 3% fee.

Next, let’s talk about aggregators. An aggregator is a marketplace that compiles all listings from various exchanges (OpenSea, LooksRare, and X2Y2). It’s the preferred method of buying/selling, as the price may fluctuate given the different royalty fees.

Aggregators

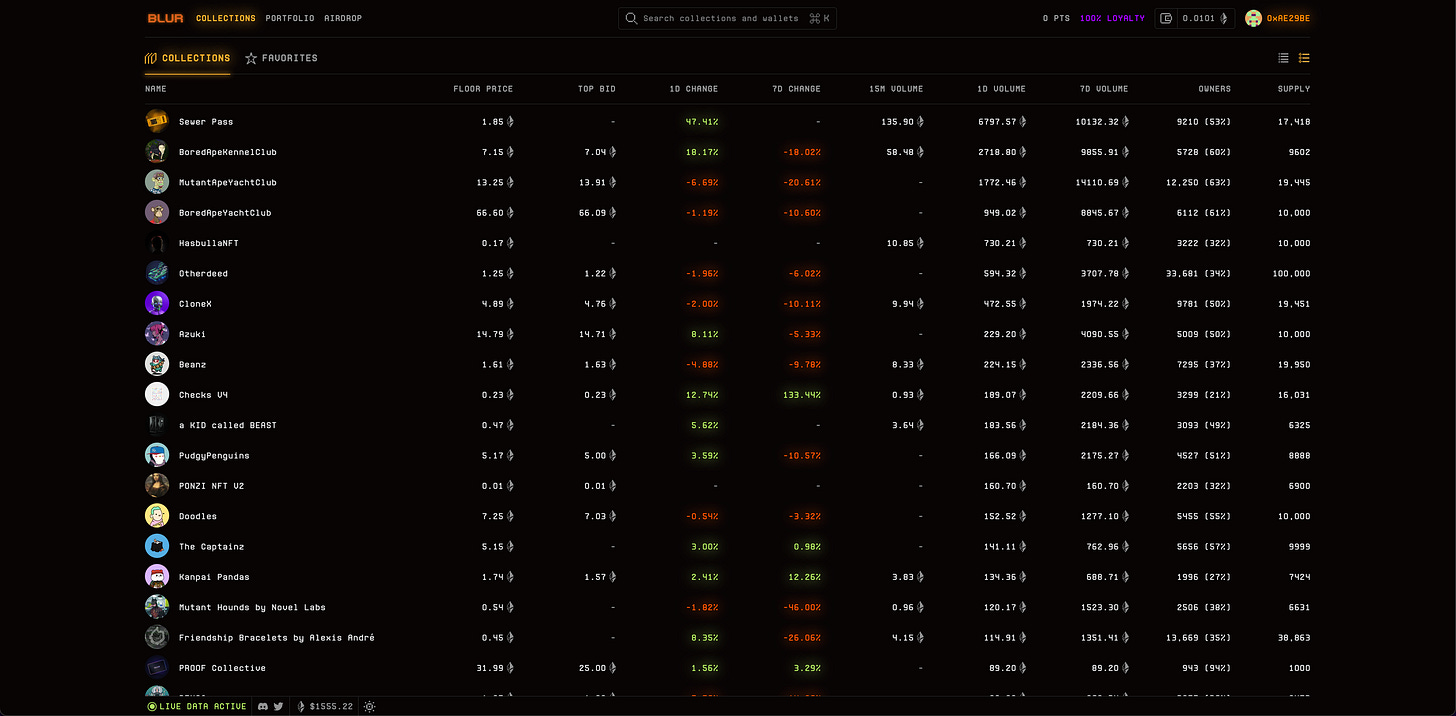

Blur:

Blur was founded in October 2022, and it’s unique as it’s both a marketplace and an aggregator. As a VC-backed digital marketplace, it’s transformed how traders buy and sell because of its simplistic UI/UX and almost 10x faster transaction speed than its competitors. It currently has the most volume out of any exchange on Ethereum.

Uniswap NFT (prev. Genie)

Uniswap NFT (previously known as Genie) was launched in November 2021 as the first NFT aggregator on the market. Allowing users to browse, buy, and sell across major NFT marketplaces. In June 2022, Genie was acquired by Uniswap Labs, which intends to integrate NFTs into their developer APIs and widgets.

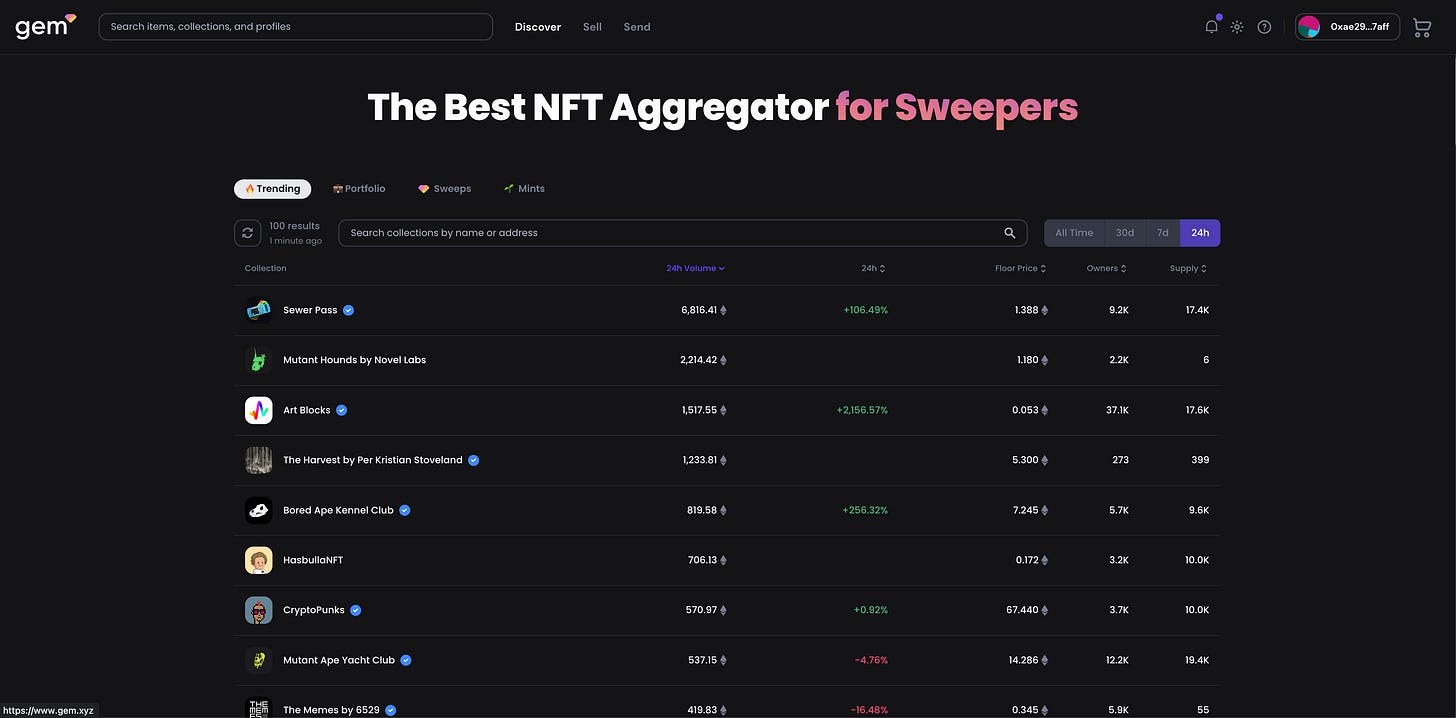

Gem:

Gem was founded in Jan 2022 as an NFT aggregator; it grew in volume as more marketplaces, such as X2Y2 and LooksRare, appeared on the market. In April 2022, OpenSea acquired Gem. As a result, the powerhouse exchange could implement batch-purchasing on its platform.

Next, let’s review a couple of Data Analytic tools for NFTs.

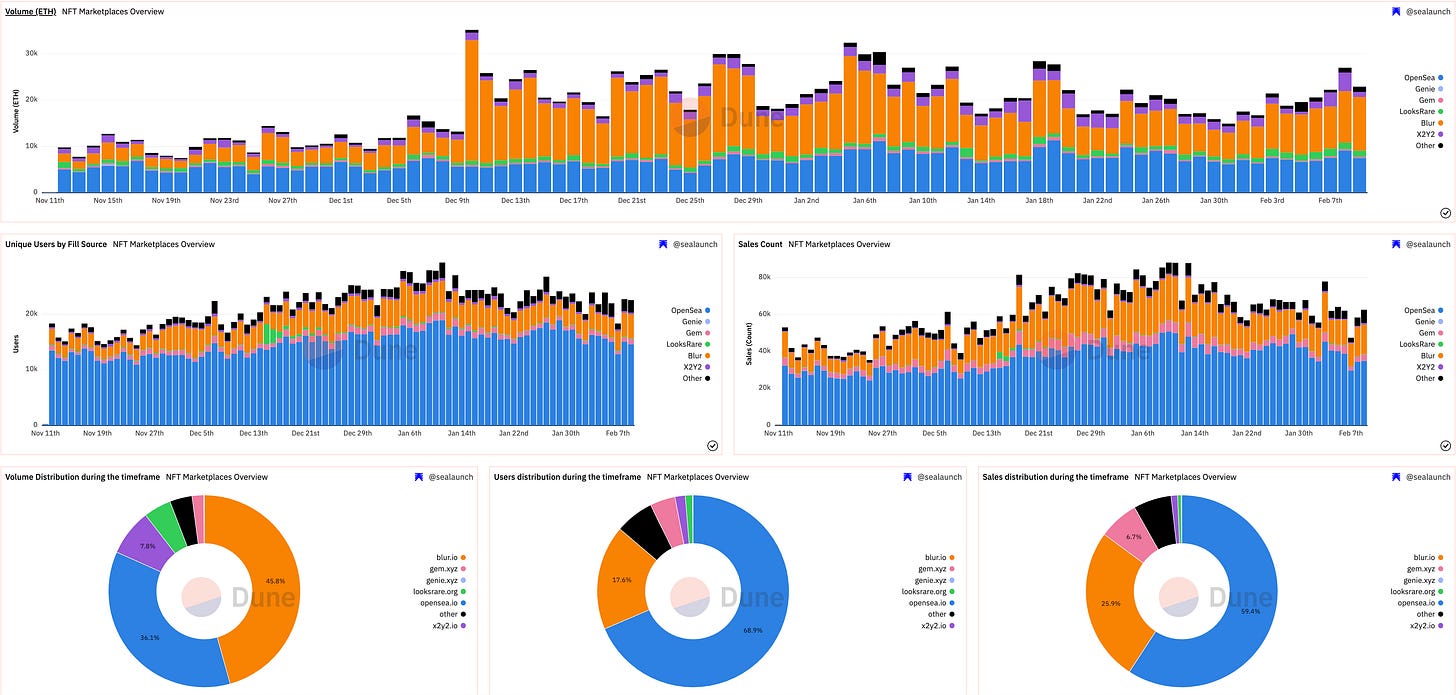

Dune Analytics:

Dune Analytics is “a community-based open-source data provider which allows anyone to publish and access crypto trends in real-time.” It allows for easy access and ability to build dashboards with various uses, from analyzing floor price, holder distribution, and more.

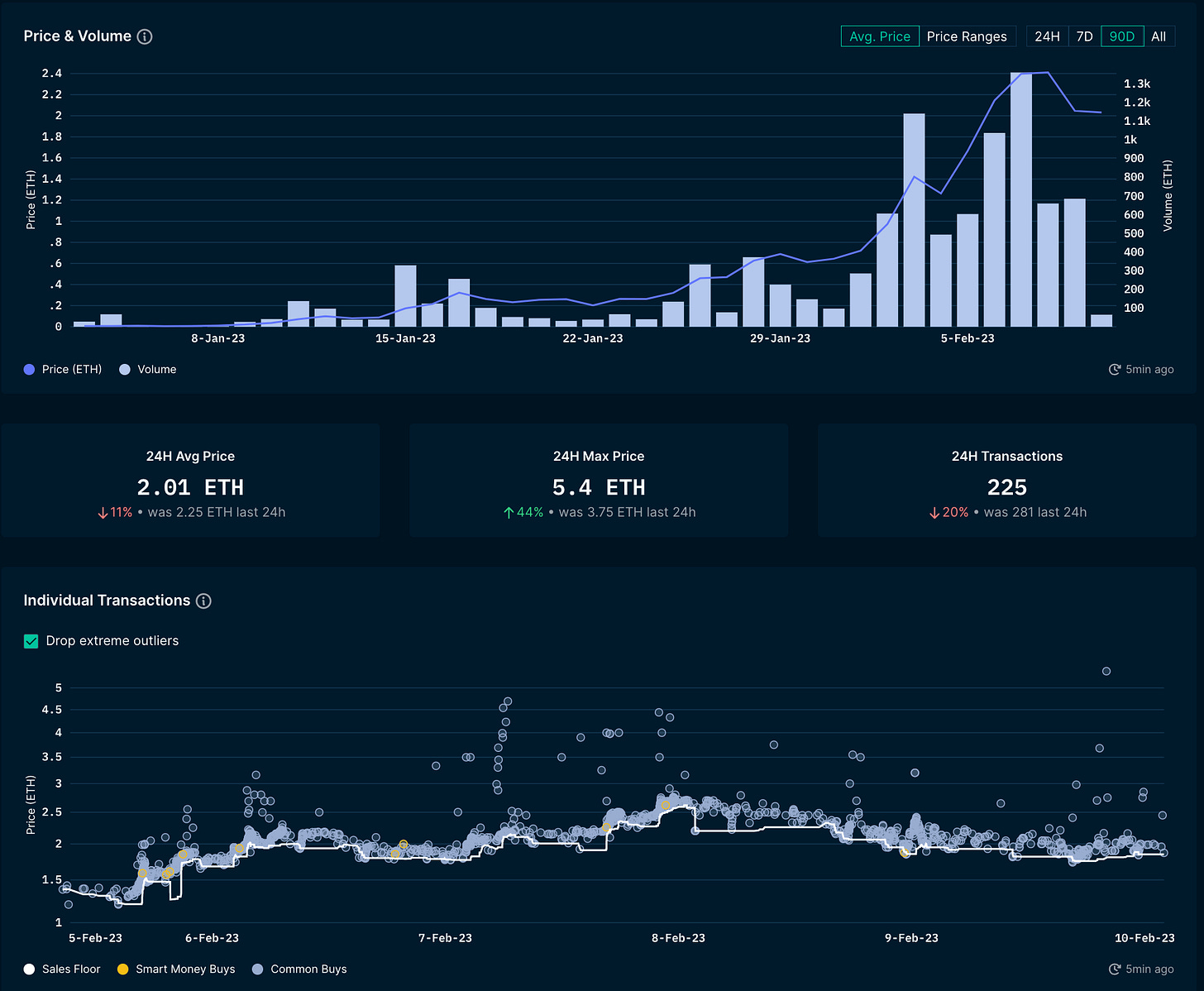

Nansen:

Nansen is “a blockchain analytics platform that enriches on-chain data with millions of wallet labels.” From individual transactions with floor indicators and smart money buys, it’s a great way to track what smart money is buying/selling in the NFT market. There is a free version, but it’s pretty limited. Memberships can range from $100/month to $2,000/month, depending on the program.

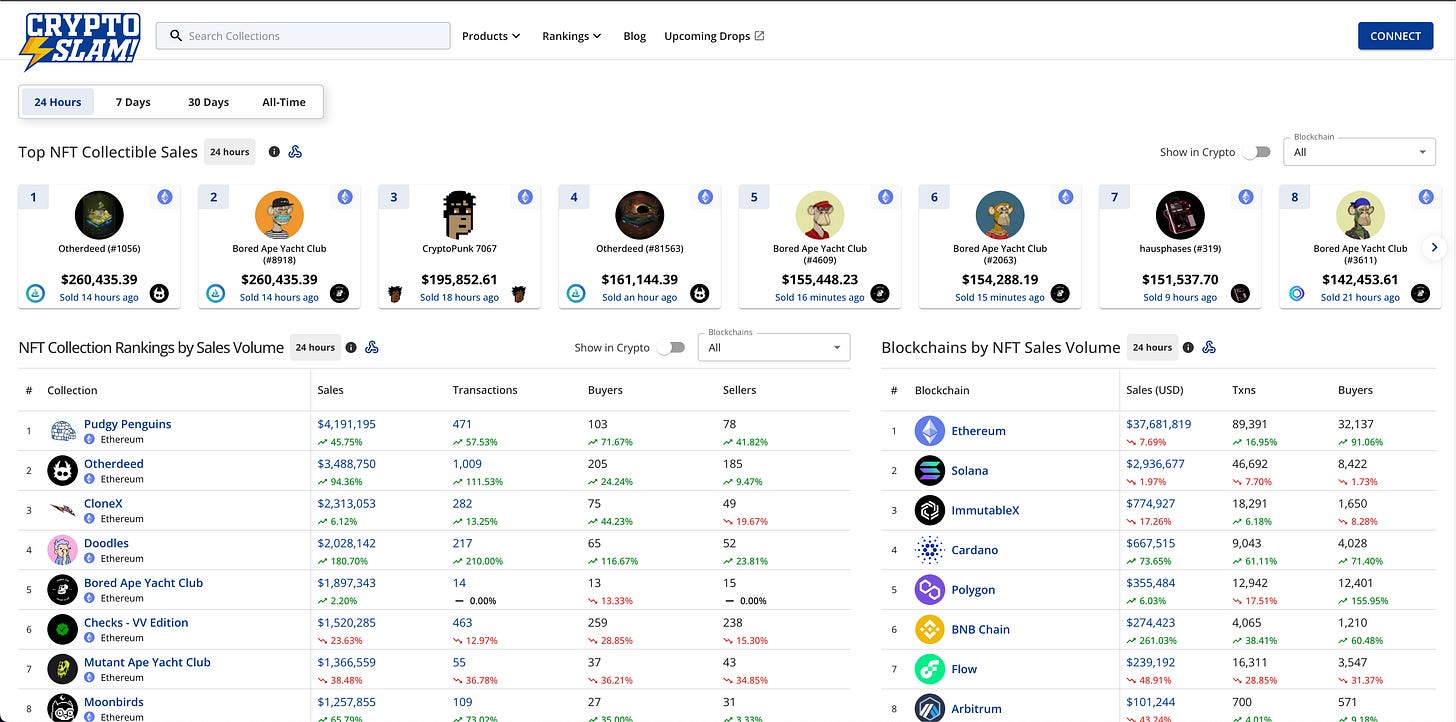

CryptoSlam:

Cryptoslam is an NFT industry data aggregator with features from project analytics, NFT values, rarity, scarcity, and activity history. It’s a great platform to capture all data across various blockchains with different timestamps.

Now, let’s review some possible trading strategies that work for the top traders.

Be early, and get a whitelist spot to buy at cost.

Finding a Discord early and getting a whitelist spot is great when you first start trading NFTs since you’ll be less liquid. It allows you to buy into a project as the floor (mint price), and depending on hype, supply, and demand, you’ll be able to profit off the trade.

Find a common thread in new projects that are doing well.

Attention is the newest currency in NFTs. “Meta,” or the most hype trend, is the common thread to look at. Take Azuki, for example; when they first came out, anime was the meta. There were 50+ projects centered around anime for the following months proceeding the blow-up for Azuki. Once you find a commonality in the meta, be there early, and take the profit knowing it’s where all the attention is at.

Use data tools to find trending volume early into the pump.

Dune Analytics, Nansen, or Cryptoslam are some of the dozens of tools out there. Find the data tool that best fits your trading strategy and use it to your advantage. For example, projects with “smart money” buy into them before anyone else. Locating buying opportunities and finding trending early volume is critical when taking a profit. If you see 10+ threads on Twitter about the project, you’re most likely late and exit liquidity.

These are just some of the many trading strategies out there; find the one that matches your frequency, liquidity, and bandwidth. The last thing you want to do is copy trade an “influencer” and wait for someone to tell you when to buy or sell.

Finally, let’s go over some soft skills you should focus on as an NFT Trader.

Patience

Adaptability & Flexibility

Mental Fortitude

Self-Awareness

Soft skills are HIGHLY underrated in this space. The best traders in this space are the most patient, willing to adapt and remain flexible, and they have the mental fortitude to stay in the trade and the self-awareness to know when to get out of it.

In conclusion, I hope this article finds you well. This is everything I wish I had known before getting started in this space. It’s a challenge, so take your time. It’s not easy, so be easy on yourself. Always remember that the only thing you need to do to thrive in this space is survive.

Images provided by:

Beeple, 101Blockchains, OpenSea, LooksRare, X2Y2, Blur, Gem, Uniswap NFT (Genie), Dune Analytics, Nansen, and CryptoSlam